I am sure you also don't run after the most recent best performing investment strategy. I stopped doing this, a long time ago, after I (quite a few times) discovered I was the last to jump on the strategy just as it stopped working.

But I suspect you also find it interesting to see what has worked well so far this year.

That is why I decided to take a look at what investment strategy would have given you the best return so far 2016.

What we tested – 7,000 companies worldwide

We looked at the performance of 18 investment strategies over the nearly 5 month, period from 1 January 2016 to 25 May 2016.

Only companies worth more than $50 million

We excluded companies with a market value less than $50 million, to make sure that we only look at companies you can buy and sell easily.

Markets worldwide

We included markets worldwide because only when you look at markets worldwide can find the best companies that fit your investment strategy.

The following markets were included:

- USA

- Canada

- Eurozone countries

- United Kingdom

- Switzerland

- Norway

- Denmark

- Sweden

- Australia

- New Zealand

This gave us a list of about 7,000 companies.

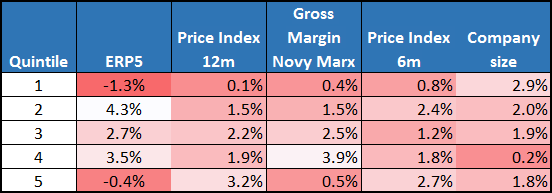

What did not work?

Let us first look at what strategies did not work so far this year.

The following strategies did not do well:

- The ERP5 investment strategy (funny enough only the best ranked companies performed badly)

- Momentum (upward moving share price) over the past 12 months

- Companies with a high Gross Margin (high quality companies) as defined by Professor Novy-Marx

- Momentum (upward moving share price) over the past 6 months

- The markets overall as can be seen in the performance of all size companies (large companies had the best return)

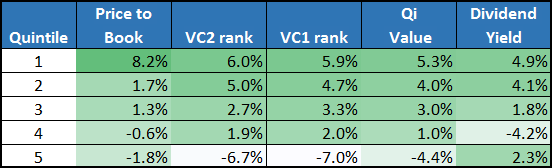

What worked?

Far more interesting of course is what strategies did do well.

This would have been your best strategies so far this year:

- Low price to book companies BUT only the cheapest 20% price to book companies (perhaps a few bombed out resource companies that recovered)

- James O’Shaughnessy’s Value Composite Two ranking

- Qi Value ranking, the strategy we developed from a combination of the best ratios we have tested

- A high Dividend yield strategy

How to Read the tables

In all the back tests we divided the 7,000 companies into five 20% groups called Quintiles.

Quintile 1 included the companies that had the best value of the ratio or indicator we tested. For example, with the price to book ratio Quintile 1 included all the companies with the lowest price to book ratio and with Value Composite Two, Quintile 1 included all the companies with the best ranking.

Your crystal ball is better

Please remember just because a strategy did well so far this year does not mean it will continue to do so for the rest of the year.

I hate (and do not make forecasts) because I am very bad at it. You are probably a lot better at it than I am.

Your performance tracking analyst

Wishing you profitable investing

PS Get all the tools to implement these strategies in your portfolio sign up here.

PPS Why not sign up right now, if you do not like it you get 100% of your money back