This Quality Value Momentum (QVM) investment strategy contains the best ideas from our research paper Quantitative Value Investing in Europe: What works for achieving alpha as well as all the research we have done since then.

How you can earn +1142% over 13 years

This article shows you the back tested results of the investment strategy over 13 years as well as exactly how to implement it in your portfolio as well as .

The strategy is a combination of quality, value and momentum, all the factors we have found that can give you the highest possible returns.

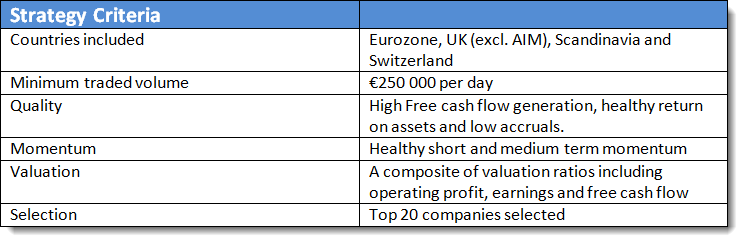

This is how the companies were selected:

How are the companies selected?

Quality

The first thing we do is remove all the low quality companies from the list of possible investment ideas.

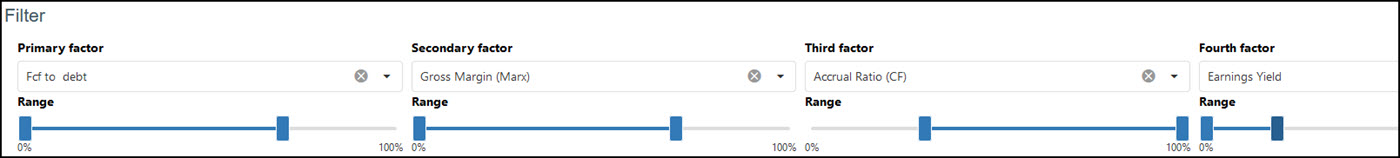

First remove companies that generate a low level of free cash flow to total debt (a company must generate cash to repay its debt). Use the FCF to debt ratio in one of the sliders in the screener and select 0% to 70%. This gets rid of the worst 30% of companies.

Secondly remove companies that have a low return on assets. Research has shown that companies with a low return on assets don't generate high returns. Use the ratio Gross Margin (Marx) and select 0% to 70% with the slider.

Thirdly remove companies where there's a big difference between the profits and the free cash flow the company generates. Again because research has shown that companies with free cash flow nearly equal to profits (low level of accruals) give you much higher returns. Use the ratio Accrual Ratio CF and select 30% to 100% with the slider.

Valuation

After removing all the low quality companies we select the top 20% of companies with the highest earnings yield (EBIT to enterprise value). Use the ratio Earnings Yield and select 0% to 20% with the slider.

Most of the time the simplest ideas lead to the best results, this is definitely true of this valuation ratio as numerous research studies have shown that this is the most effective valuation ratio you can use to look for high return investments.

This is what your screen should look like:

Momentum - Do this in Microsoft Excel

If there's one fact that came out of the above-mentioned research study it is that if you want high returns you must consider share price momentum.

To select investment ideas for the QVM strategy combine 3 month (Price Index 3m) and 6 months (Price Index 6m) share price momentum so that only companies with an upward moving share price are selected.

For both 3 and 6 month Price Index select the top 50% of companies with the top momentum.

To do this you must export the above results to Microsoft Excel.Click here to see how: How to export results from the Quant Investing stock screener

Inside Excel first activate the Filter function on the exported data. This article shows you how: How to Filter data in Excel

Once you have done that apply a filter to the 6m PI and 12m PI columns so you only get the top 50% - select "Above Average".

Best 20 ideas

After you have selected all the above-mentioned criteria, select the 20 most undervalued companies based on a Value Composite One rank as defined by James O'Shaughnessy in the fourth edition of his excellent book What Works on Wall Street.

To do this simply sort the Value Composite One column in Excel from low to high.

In summary a simple idea what works well

Even though this may seem really complicated the investment strategy boils down to the following simple principles:

- Remove bad quality companies

- Look for undervalued companies

- That have good share price momentum

- Choose only the most undervalued companies

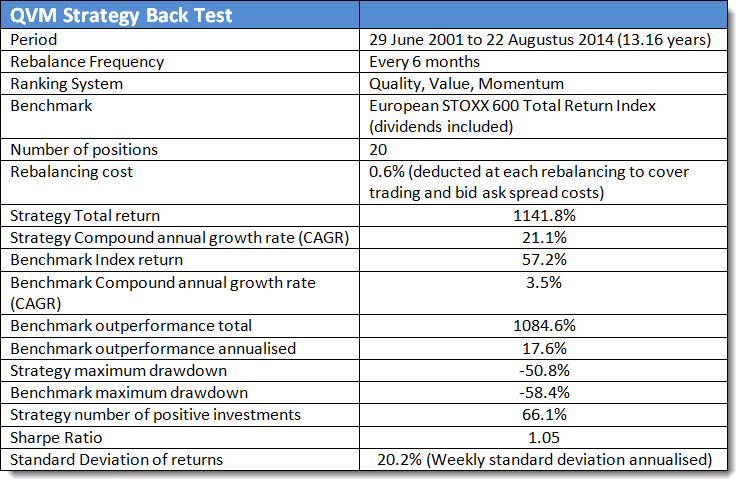

How did the strategy perform?

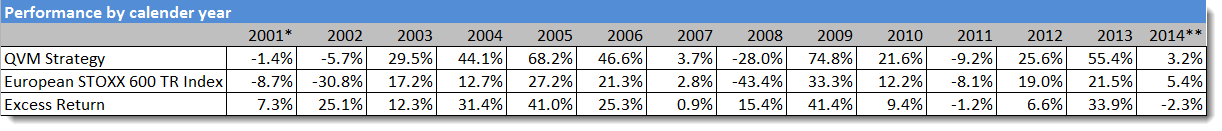

Yearly performance

The table below shows the yearly returns of the QVM strategy compared to the European STOXX Total Return index (which includes dividends):

Click image to enlarge

(*) Inception date 29-06-2001

(**) End date 22-08-2014

Growth of your investment in the strategy

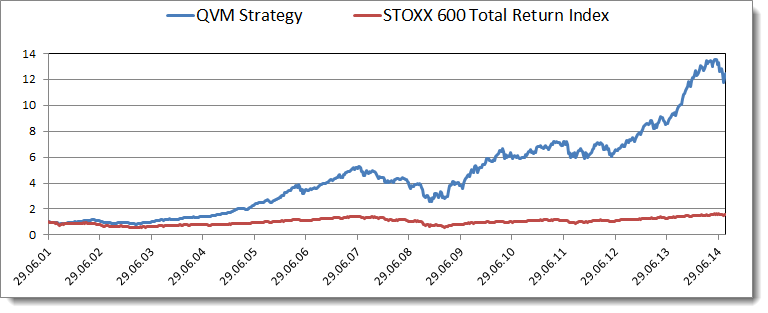

This chart shows the growth of investing €1 in the QVM strategy compared to if you invested in the European STOXX 600 Index (dividends included).

€1 grew to €12 index only €1.57

As you can see in the chart below your €1 investment in the QVM Strategy would have grown to just less than €12.

Compare this to if you invested €1 in the index you would have only had €1.57 after 13 years.

Your €10 000 grew to €114 180

This means if you invested €10 000 in this investment strategy after just more than 13 years you would have had €114 180 in the bank.

If you invested the same €1 000 in the index you would have only had €1 572 after 13 years.

This is what your returns would have looked like:

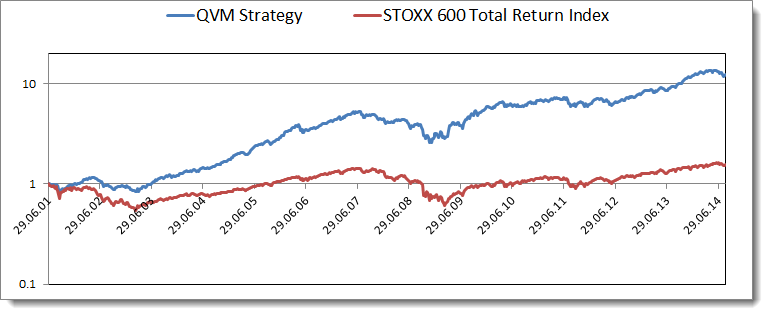

Returns logarithmic scale

This chart below also shows your return of investing €1 in the QVM Strategy and the index but it shows a logarithmic scale to show that the index was even more volatile than the QVM Strategy.

PS To implement this strategy in your portfolio sign up here

PPS It is so easy to get distracted, why not sign up now before it slips your mind...