I became a quantitative value investor after reading Joel Greenblatt’s excellent book The Little Book that Beats the Market that explained his Magic Formula investing strategy.

Since then, the same as you perhaps, I have been searching for an even better investment strategy.

An even better investment strategy

And that is exactly what I found when I read the research paper by Philip Vanstraceele and Luc Allaeys, both good friends, called Studying different Systematic Value Investing Strategies on the Eurozone stock market.

A better strategy is ERP5

In the research paper Luc and Philip set out to design and test an investment strategy that combined the following valuation and quality ratios:

- Earning Yield (EBIT / Enterprise Value) - Pre-tax earnings compared to the enterprise value or purchase price of the company

- Return on Invested Capital (EBIT / (Net Working Capital + Net Fixed Assets)) – The return a company generates ion the capital invested in the business.

- Price to Book (Market value / Book value) – share price compared to the book value of the company

- Trailing 5-year average Return on Invested Capital.

They named the strategy ERP5, based on the first letters of the 4 factors.

Click here to get the ERP5 investment strategy working in your portfolio NOW!

All companies are ranked

To get the ERP5 rank all companies are ranked on each of the four factors. These rankings are then added together to give the combined ERP5 rank of the company.

The lower the ERP5 ranking of a company is the more attractive it is as an investment idea. In other words the lower the better.

The ERP5 rank of more than 22,000 companies is available for you to use in the screener.

Does the EPR5 strategy work?

This is all very interesting, but does it work, you may be thinking.

In 2012 when a friend and I set out to find the best investment strategy in Europe over the 12 year period from June 1999 to June 2011 we tested the Magic Formula investing as well as the ERP5 strategy.

This is what we found:

Market returned only 30.5%

To put these returns into perspective, in the 12 year period the overall stock market returned only 30.54%.

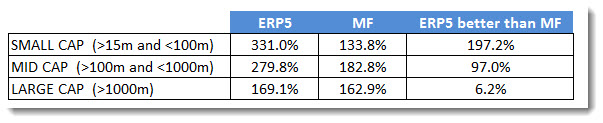

The above table shows the total 12 year return of both strategies with the last column showing how much better the ERP5 strategy did compared to Magic Formula investing.

ERP5 did a LOT better +200%

As you can see the ERP5 strategy, for all size companies, did substantially better than the Magic Formula investing strategy, in fact for small companies if you would have had done nearly 200% better.

Click here to get the ERP5 investment strategy working in your portfolio NOW!

But ERP5 returns can be improved

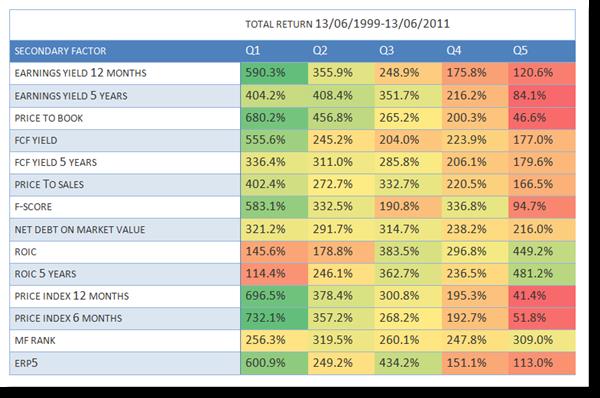

In the above mentioned back-test we also tested the ERP5 strategy with a lot of other factors and as you can see in the table below the returns of the strategy can be substantially improved.

Look at column Q1

The returns you should look at are those in column Q1. They show the returns generated by first selecting the 20% best ERP5 companies and then sorting them by the ratios in the Secondary Factor column.

732% over 12 years

This means you could have earned the highest return of 732.1% over 12 years if you invested in the best ranked ERP5 companies that also had the highest 6 month momentum or price index (6 month price increase).

Click here to get the ERP5 investment strategy working in your portfolio NOW!

Summary and conclusion

As you can see the ERP5 investment strategy deserves your attention because as a stand-alone strategy it has performed substantially better, not only than the market, but also better than the Magic Formula investing strategy.

Not only that but you can also see that if you combine the ERP5 strategy with other factors, such as 6 or 12 months price momentum you can substantially increase your returns.

PS To find ERP5 and Magic Formula investment ideas in the countries you invest in (for less than an inexpensive lunch for two) click here: Sign up Now!

PPS Why not sign up right now before it slips your mind?

Please note: This website is not associated with Joel Greenblatt and MagicFormulaInvesting.com in any way. Neither Mr Greenblatt nor MagicFormulaInvesting.com has endorsed this website's investment advice, strategy, or products. Investment recommendations on this website are not chosen by Mr. Greenblatt, nor are they based on Mr Greenblatt's proprietary investment model, and are not chosen by MagicFormulaInvesting.com. Magic Formula® is a registered trademark of MagicFormulaInvesting.com, which has no connection to this website.