The operating cash flow to capital expenditure (Capex) ratio helps you find companies where the business generates more than enough cash to fund its capital spending needs.

In the Quant Investing Screener the ratio is called Cash flow on Capex (Cfo to Capex) and is calculated as Cash From Operations / Capital Expenditure (Capex).

Cash flow greater than investment

If operating cash flow is larger than capital investment the company can use the money to repay debt, increase dividends and or buy back shares.

Cash flow less than investment

If operating cash flow is less than capital investment it means that the company needs money for capital investment which it can get either by borrowing and / or selling new shares.

This may be good if the company earns a high return on the added investment. If not it is a warning flag you want to investigate more closely.

A good ratio to find quality companies

This ratio is a good one to help you find good quality companies according to Richard Tortoriello author of "Quantitative Strategies for Achieving Alpha" and works well across all industry sectors.

Where to find it in the screener?

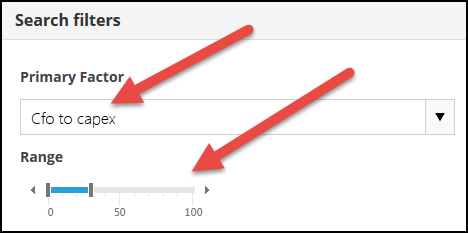

In the screener you can use the Cash Flow to Capex ratio as a screening ratio (screen for healthy companies directly) or as a output column in the results of your screen where you can use the filter function (click the funnel icon) to remove companies with a bad Cash Flow to Capex ratio.

Cash Flow to Capex as a primary screening factor

PS To start using the operating cash flow to capital expenditure ratio to find investment ideas sigh up right here.

PPS It is so easy to put things off why not sign up right now?