I am sure you have also seen a lot of articles telling you how expensive or overvalued markets are - especially in the USA.

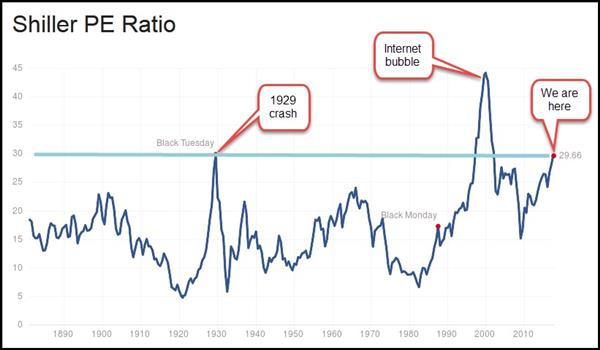

For example like this chart:

Source: Schiller PE

What is the Schiller PE?

This chart shows you the Price to Earnings ratio of the S&P 500 based on average inflation-adjusted earnings from the previous 10 years. It is known as the Cyclically Adjusted Price to Earnings Ratio (also known as the CAPE Ratio, Shiller PE Ratio, or PE 10).

As you can see only once has the market been more expensive than this and that was during the internet bubble – and we all know how that ended.

Will the market crash?

This high valuation brings with it a lot of speculation about a market crash - if it will take place and when.

No one of course has any idea as to when or if it will take place, but if someone writes about it, it makes for a good headline that gets a lot of clicks.

You know I do not make market predictions so I, the same as you and all the "experts" have no idea if or when a crash will take place – but that is not what is important.

What is important to do now

What is important is, how you invest in the current market environment and what returns you can expect – if the market is already so expensive.

It is a good question that nobody really knows the answer to but here is something that can help us.

It is a chart published by one of the few asset managers you can trust.

Everything they publish is helpful and best of all it's completely free. All you have to do is go to www.GMO.com register for free and tick the box that you want to be notified of the future publications.

Returns for the next 7 years

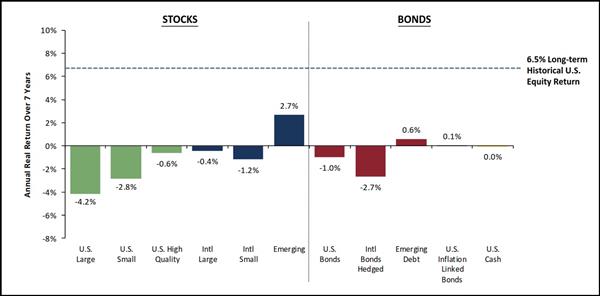

Each month GMO publishes a chart that shows you what seven year annual real (after inflation) return you can expect for a number of asset classes.

Because the returns are based on mean reversal (valuations tend to return to what they have been on average over long periods of time) they have been surprisingly accurate.

Here is an example of the returns GMO says we can look forward to over the next seven years:

Source: www.gmo.com (Free registration required) as of 31 July 2017

Nothing to get excited about

As you can see there's nothing to get excited about. US large company returns look horrible (-4.2%) with small companies not far behind.

The only asset that looks like it will give you a half decent return - but at 2.7% is not really exciting - is emerging market equities.

But do you want to invest in emerging markets for that small return compared to the risk? I don't know about you but I do not want take that much risk.

Let’s get back to the Quant Value newsletter.

What about the newsletter?

As you know the newsletter has been avoiding expensive markets – mainly the USA but more recently Europe – for quite some time already.

That is why the cash part of these two newsletter portfolios is so high - in North America its 87% and in Europe 80%.

This is not that we want you to hold cash, it is because there are simply no undervalued good quality companies we could find to recommend to you.

The only place worth investing

The only bright spot where I have been able to find quite a lot of very undervalued companies for you is Asia, mainly Japan.

But like you, I do not want to invest my whole portfolio in Japan – a maximum of 30% to 40% is what I am comfortable with.

Your level will be different and that is fine – as I have mentioned in the past the best portfolio for you is the one that lets you sleep comfortably every night.

So what does this all mean?

This is all very interesting but what should I do now, you may be thinking?

1. Avoid expensive markets

If you have a lot invested in the US market think seriously about reducing it.

In the newsletter, no new ideas, the selling of old ideas and the strict stop-loss system we follow will automatically reduce your investments there.

2. Be careful of Europe

Europe is not cheap any more, and the same as the USA, the cash part of this newsletter portfolio is increasing.

3. Asia is attractive

As I said Asia is the only market that is even mildly attractive at the moment.

Set a limit to the part of your portfolio you want to invest there – a limit you are comfortable with - there is no right or wrong answer here.

I am comfortable investing up to 40% in Asia. At the moment I have 22% of my portfolio there, mainly in Japan.

4. Don’t be afraid of cash

Don’t be afraid of holding cash, inflation is low and you won't be holding it forever.

Cash gives you the freedom to invest when other investors are selling at mad prices because they just want to get out – that makes it a very valuable asset even though it’s hard to hold when all the markets are moving up, as they are at the moment.

PS This article was the editorial of September issue of the Quant Value newsletter. To get information like this on a monthly basis sign up here

PPS You can find more information on the newsletter here: About the Quant Value Newsletter.