Estimated Reading Time: 7 minutes

Discover how stop-loss strategies can protect your investments and increase your returns.

This article reviews three key research studies showing that stop-loss rules, especially trailing ones, help limit losses and increases returns.

You'll learn the best stop-loss percentages to use, how they work, and practical steps to implement them in your portfolio. Whether you prefer a simple or trailing stop-loss, this strategy can help you manage risks and make better decisions.

Read on to see how stop-losses can transform your investing approach and protect your capital.

Further Reading:

How to lower your losses and increase returns - Stop loss orders

How to implement the trailing stop loss rule

Navigating Market Storms: Taming Investment Volatility

How to add a Trailing Stop Loss to any stock - Get email alert

These ideas on how to sell increase profits and lower losses

I never used stop-loss orders, mainly because some limited testing I did found that a stop-loss strategy lead to lower returns even though it did reduce large losses.

But you know here at Quant Investing we look at investment research all the time and I found three interesting papers that tested stop-loss strategies with results that changed my view completely.

But before we get to HOW and WHAT stop loss you can use to increase your returns first the reason why you must keep losses low.

Why It Is Important to Keep Losses Low

In my over 38 years of investing experience, I noticed people often lose their ability to think clearly when they face big losses. I am sure you have also experienced this.

Your careful analytical judgment disappears.

The confidence (perhaps too much) you had when markets were going up turns to fear when headlines are scary, and you and your friends are losing money.

I learned that my judgment gets cloudy and far too negative in tough times. But I have seen that if I keep my thinking clear (with a system) and my money available, the rare periods of market panic create special opportunities, like in 2008 when everything got cheap.

If you have the emotional strength and cash to buy during these times, you can make big games gains. That is when we started the special Market Crash portfolios for newsletter subscribers, both of which posted great returns.

This means if you avoid large losses, your capital works like a ratchet. You make money, keep it, then make more, an upward spiral.

That is why it is never a good idea to compare yourself strictly to benchmarks. Obviously, you need to make a return on the money you invest yourself. But the great thing if you don't chase benchmarks is you don't have to ride them all the way down.

Research study 1 - When Do Stop-Loss Rules Stop Losses?

The first research paper When Do Stop-Loss Rules Stop Losses? and was published in May 2008 by Kathryn M. Kaminski and Andrew W. Lo.

The paper looked at the application of a simple stop-loss strategy applied to an arbitrary portfolio strategy (for example buying the index) in the US over the 54 year period from January 1950 to December 2004.

How was the stop loss applied?

The strategy used a simple 10% stop loss rule. When a 10% loss was exceeded the portfolio was sold and invested in long term US government bonds.

Cash would be moved back into the stock market once the 10% fall in the stock market was recovered (the 10% stop-loss was recovered).

What they found it worked very well

The researchers found that when the model was invested in the stock market it gave higher return than bonds 70% of the time, and during stopped-out periods (when the model was invested in bonds), the stock market provided a higher return only 30% of the time.

So it worked!

Over the whole 54 year period the study found that this simple stop-loss strategy provided higher returns while at the same time limiting losses substantially.

They also found that the stop-out periods were relatively evenly spread over the 54 year period they tested. This shows you that the stop-loss was not just triggered by a small number of large market movements (crashes).

If the researchers excluded the technology bubble (used data from Jan 1950 to Dec 1999) the model worked even better. This was because it got back into the stock market too quickly after the technology bubble crash.

This was most likely because the stop loss level was set too low. For a better stop loss level look at the next research studies.

To find investment ideas that fit your investment strategy - Click here

Research study 2 – Performance of stop-loss rules vs. buy and hold strategy

The second research paper was called Performance of stop-loss rules vs. buy and hold strategy, published in 2009 by Bergsveinn Snorrason and Garib Yusupov.

What they tested

They compared the performance of following a trailing and normal stop-loss strategy to a buy and hold strategy on companies in the OMX Stockholm 30 Index over the 11 year period between January 1998 and April 2009.

This is a short test period but it included the bursting of the internet and the financial crisis.

Investments were made on the first trading day of every quarter (starting January 1998). When a stop-loss limit was reached, the stocks were sold and cash was held until the next quarter when it was reinvested.

What is really helpful is they tested stop-loss levels from 5% to 55%.

Trailing stop-loss results

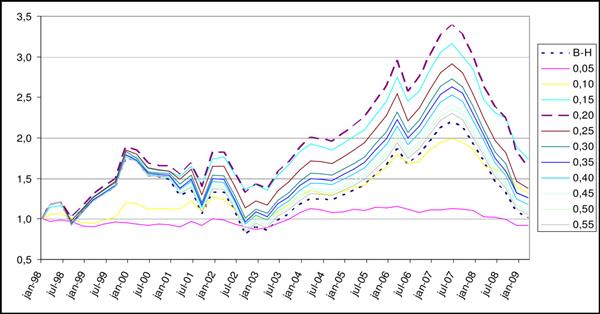

The table below shows the results of the use of a trailing stop-loss strategy.

As you can see the highest average quarterly return (Mean = 1.71%) was obtained with a 20% trailing stop-loss level limit. The highest cumulative return (Cumulative = 73.91%) was achieved with a 15% trailing stop-loss limit.

The only stop-loss level that did worse than the buy-and-hold (B-H) portfolio, with a negative average return of 0.12% and cumulative return of -8.14%, was from a trailing stop-loss strategy with 5% loss limit.

Returns from using a trailing stop-loss strategy

Click image to enlarge

The following chart shows the total end value of all the strategies.

Trailing Stop-loss, equally-weighted total portfolio performance

Click image to enlarge

As you can see the 15% and 20% trailing stop loss levels give you about the same overall result with the 20% stop-loss level leading to higher returns most of the time.

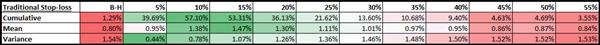

Traditional stop-loss strategy - not trailing

The following table shows you the results if you applied a traditional stop-loss strategy, which means that you would calculate the stop-loss from the purchase price.

Returns from using a traditional stop-loss strategy

Click image to enlarge

Surprisingly, all traditional stop-loss levels from 5% to 55% would have also given you better returns than the buy and hold (B-H) strategy.

The highest average quarterly return (Mean = 1.47%) was achieved at the 15% stop loss level and the highest cumulative results of 57.1% at the 10% stop-loss level closely followed by the 15% stop-loss level at 53.31%.

The chart below shows you the results of the traditional stop-loss strategy for all tested stop-loss levels.

Traditional Stop-loss, equally-weighted total portfolio performance

Click image to enlarge

In the chart you can see that the 15% loss level would have given you the best result over the largest part of the 11 year test period.

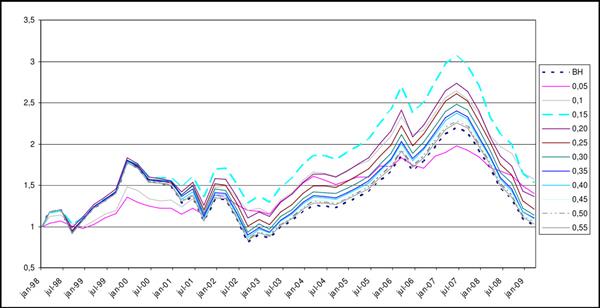

What is the best stop loss strategy?

So what is the better stop-loss strategy?

To find out we deducted the results of the traditional stop-loss strategy from the trailing stop-loss strategy.

The results are summarised in the following table:

Trailing stop-loss minus Traditional stop-loss

Click image to enlarge

Trailing stop loss is LOT better

Only at the 5% and 10% stop loss levels did the traditional stop-loss perform better than the trailing stop-loss BUT the overall returns were bad.

At all other loss levels the trailing stop loss outperformed, most notably at the 20% stop loss level where it performed 27.47% better over the 11 year period.

To find ideas that EXACTLY fit your investment strategy - Click here

Research study 3 - Taming Momentum Crashes: A Simple Stop-loss Strategy

The third research study is called Taming Momentum Crashes: A Simple Stop-loss Strategy by Yufeng Han (University of Colorado), Guofu Zhou (Washington University) and Yingzi Zhu (Tsinghua University) and was published in August 2014.

What they tested

The researchers applied a simple momentum strategy of each month buying the 10% of companies with the largest price increase over the past six months and selling short the 10% of companies with the largest price falls the past six months.

Once the stop-loss was triggered on any day the company was either sold (Winners) or bought (Losers) to close the position. Remember this was a long-short portfolio.

If a position was closed the proceeds were invested in the risk-free asset (T-bills) until the end of the month.

Tested over 85 years

They applied this strategy over the 85 year period from January 1926 to December 2011 on all US domestic companies listed on the NYSE, AMEX, and NASDAQ stock markets (excluding closed-end funds and real estate investment trusts).

A lot lower losses

At a stop-loss level of 10%, they found that the monthly losses of an equal weighted momentum strategy went down substantially from −49.79% to −11.34%.

For the value-weighted (by the last month-end market value) momentum strategy, the losses were reduced from −65.34% to −23.69% (to -14.85% if August 1932 is excluded).

And Higher Returns

Not only did the use of the simple stop loss strategy reduce losses it also increased returns.

The stop-loss strategy increased the average return of the momentum strategy from 1.01% per month to 1.73% per month (a 71.3% increase), and reduced the standard deviation of returns from 6.07% per month to 4.67% (23% reduction).

It also increased the Sharpe ratio (measure of risk adjusted return) of the stop-loss momentum strategy to 0.371, more than double the level of the original momentum strategy of 0.166.

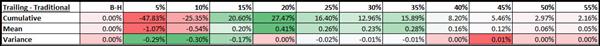

Helps you avoid market crashes

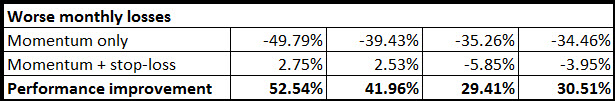

The stop-loss momentum strategy also completely avoided the crash risks of the original momentum strategy as the following table clearly shows.

Click image to enlarge

Note that if you followed a stop loss strategy you would have made a small profit when the momentum only strategy lost nearly 50% and 40%.

Do you hate price driven stop loss strategies?

Do you hate a price driven stop-loss system? If so you are most likely a hard core value investor.

Here is something you may want to consider, a fundamental stop loss suggested by a friend and long-term subscriber to the Quant Investing stock screener.

You can read the whole article here:

Ever thought of using a fundamental stop-loss?

Summary and Conclusion - Stop-loss strategies work

This has been a long article to show you that stop-loss strategies work

As you have seen:

- When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially

- A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy

- The best trailing stop-loss percentage to use is either 15% or 20%

- If you use a pure momentum strategy a stop loss strategy can help you to completely avoid market crashes, and even earn you a small profit while the market loses 50%

- Stop-loss strategies lowers wild down movements in the value of your portfolio, substantially increasing your risk adjusted returns

The Difficult Part - Your Emotions

The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over again.

The difficult part is to not let your emotion keep you from selling when a stop-loss level is reached.

How to Implement Your Stop-Loss Strategy

This is how you can implement a stop-loss strategy in your portfolio, it is also the stop loss strategy we use in the Quant Value investment newsletter.

- Implement a trailing stop-loss strategy where you calculate the losses from the maximum price the company has reached since you bought it

- Only look to see if the stop-loss has been exceeded on a monthly basis. If you look at it daily you will trade too much and the costs will lower your returns

- Remember to include dividends. When a company goes ex dividend (trades without the dividend) its stock price drops by the amount of the dividend so you have to add the dividend to the current stock price, here is the formula: (Current stock price - the highest stock price + the dividend per share) / the highest stock price.

- Sell your investment if at the monthly evaluation date the trailing stop-loss level of 20% has been exceeded

- Measure the trailing stop-loss in the currency of the company’s primary listing. This means measure the stop-loss of a Swiss company in Swiss Francs (CHF) even if your portfolio currency is Euros or US Dollars

- Reinvest the cash from the sale in the best idea that currently fits with your investment strategy. If you subscribe to the newsletter you would invest in the ideas you receive the month the investment is sold

It Will Not Always Work

These studies all showed the success of a stop-loss strategy over long periods of time, this of course does not mean that a buy and hold strategy will not sometimes outperform your stop-loss strategy.

But over the long term it will reduce your portfolio’s volatility (large losses) and increase your compound investment returns. This will also help you stick to your investment strategy!

System that sells your losers to invest in your best ideas

What a stop loss strategy also does is it gives you a disciplined system to sell losing investments, let your winners run, and invest the proceeds in your current best ideas.

PS Do you hate a price driven stop-loss system? If so here is an idea that will help you limit your losses if the underlying business of your investment starts to go downhill. Ever thought of using a fundamental stop-loss?

PPS To find investment ideas that EXACTLY fit your investment strategy click here

It is so easy to get distracted, why not sign up right now? It costs less than an expensive lunch for two and if you don't like it you get your money back.

To find investment ideas that EXACTLY fit your investment strategy - Click here

Frequently Asked Questions About Stop Losses

Beginning Investors FAQs

1. What is a stop-loss strategy, and why should I consider using it?

A stop-loss strategy is a method used in investing to limit losses on an investment. By setting a predefined point at which your investment will be sold (stop loss order), you can prevent significant financial loss. Research shows that employing a simple stop-loss strategy can enhance returns while simultaneously reducing losses, making it an effective tool for managing risk in your portfolio.

2. What does the research say about the effectiveness of stop-loss strategies?

Multiple studies have shown that stop-loss strategies can be beneficial. For instance, one study demonstrated that over a 54-year period, a simple stop-loss strategy outperformed bonds 70% of the time when the market was rising and limited losses by investing in bonds during downturns. This suggests that stop-loss strategies can provide higher returns and lower losses over time.

Another study focusing on the OMX Stockholm 30 Index revealed that a trailing stop-loss strategy, especially with a 15% or 20% loss limit, significantly outperformed a buy-and-hold strategy over an 11-year period, including then the internet bubble burst and the financial crisis. This further underscores the effectiveness of stop-loss strategies in providing higher returns and reducing losses over time, across different markets and economic conditions.

3. What’s the difference between a trailing and traditional stop-loss strategy?

A trailing stop-loss strategy adjusts the stop-loss level as the price of an asset increases, locking in profits.

A traditional stop-loss strategy sets the stop-loss level based on the purchase price. Research suggests that trailing stop-loss strategies often yield better returns than traditional ones, especially at certain loss levels.

4. What stop-loss percentage should I use?

According to research, the most effective stop-loss levels for maximising returns while limiting losses are between 15% and 20%. These levels strike a balance between allowing some market fluctuation and protecting against significant downturns.

5. Can stop-loss strategies prevent large portfolio losses during market crashes?

Yes, employing stop-loss strategies or stop loss orders, especially with momentum investing, can significantly reduce the impact of market crashes. Studies have shown that well-implemented stop-loss orders can even turn potentially massive losses into minor gains by avoiding the worst periods of market downturns.

Advanced Investors FAQs

1. How do stop-loss strategies affect the Sharpe ratio and overall portfolio volatility?

Implementing a stop-loss strategy can improve the Sharpe ratio—a measure of risk-adjusted return—by lowering portfolio volatility and enhancing returns. For example, a study found that a stop-loss orders increased the average return from 1.01% to 1.73% per month and reduced the standard deviation of returns, leading to a more favourable Sharpe ratio.

2. What are the implications of using a stop-loss strategy on momentum investment strategies?

For momentum strategies, a stop-loss strategy can drastically reduce losses and increase returns by selling assets that hit a predetermined loss level and reinvesting in safer assets. This approach helps to tame momentum crashes, allowing for higher and more stable returns over time.

3. How should dividends be accounted for in a trailing stop-loss strategy?

When implementing a trailing stop-loss, it’s important to adjust for dividends. Since a stock's price drops by the amount of the dividend on its ex-dividend date, you should add the dividend to the current stock price when calculating whether the stop-loss price has been breached. This ensures that normal dividend payments do not inadvertently trigger the stop-loss orders.

4. Is there a preferred frequency for evaluating stop-loss triggers?

It's advisable to check for stop-loss triggers monthly rather than daily. This approach reduces transaction costs and avoids the over-trading that can erode returns. Monthly evaluations strike a balance between reacting to market movements and maintaining strategic discipline. Weekly may be more appropriate for pure momentum strategies.

5. Can stop-loss strategies be integrated with value investing principles?

Yes, while stop-loss strategies are typically associated with momentum strategies, they can also be adapted for value investing. For instance, a fundamental stop-loss could be used, where selling triggers are based on deteriorating business fundamentals rather than stock price movements alone. This can help value investors limit losses when a company's underlying business starts to decline.

To find investment ideas that EXACTLY fit your investment strategy - Click here

Further Reading:

How to lower your losses and increase returns

How to implement the trailing stop loss rule - Stop loss order levels

Navigating Market Storms: Taming Investment Volatility

How to add a Trailing Stop loss to any stock - Get email alert

These ideas on how to sell increase profits and lower losses