You can now screen only stocks like those in the S&P Europe 350 index as we have added the the Europe 350 (EUR350) index to the Quant Investing stock screener.

What exactly is the Europe 350 index?

The Europe 350 index consists of largest market value, most liquid companies from 16 developed European countries.

Countries included are: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the UK.

How to select the Europe 350 index?

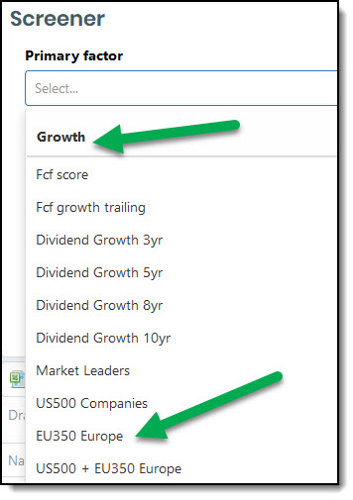

After you have logged into the screener click the drop down list below Primary Factor and under the heading Growth select EUR350 Europe.

How to select the EUR350 index

PS To get this index and ideas from the above strategies working in your portfolio sign up here.

PPS Why not sign up now, while this is fresh in your mind?