On 3 December 2015 our database team had a great idea - let's save all the ratios of all the companies in the stock screener into a separate point-in-time database.

They started as soon as they could and every day since 4 December 2015 we have saved every ratio for all the companies in the screener. This means every day we saved 110 ratios of 22,000 companies.

Why are we doing this? A point in time database

Why are we doing this and how can this help you?

The reason was to build up a past database of actual ratios and indicators of all the companies in the screener on a specific day - this is known as a point in time database.

The data does not go back very far yet, only till 4 December 2015. But it’s a good start and it grows every day.

You can now screen in the past!

We have just finished adding this database to the screener so it is ready for you to use. This means you can go back in time and see exactly what companies fit your investment strategy and how they have performed.

You can thus back test any stock screen or investment strategy you want to.

And this is not using calculated back test ratios but actual values as they were on that day in the past. There is thus no look-ahead or survivorship biases in the database.

Click here to start back testing your investment strategy Now!

How to screen the past

This is how you can start using the historical point in time database.

I expand on all these points below but here are the steps if you know the screener:

- Login and load the screener

- Set up or load a stock screen

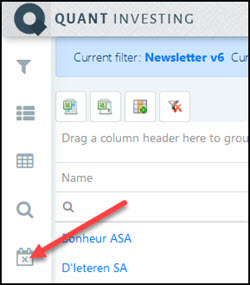

- Click the Historical Screener icon

- Select the date in the past you want the screener results for

- Click Confirm to get the historical screener results

Detailed steps

Here are the detailed steps for you to screen in the past point in time data.

1. Login and Set up or load a saved screen

For instructions on exactly how to log in and set up a screen look at this article: How to run your first screen with the Quant Investing screener

2. Get historical results of your screen

Once you have run your screen and you have a list of companies that fit the screen criteria you are ready to go back in time.

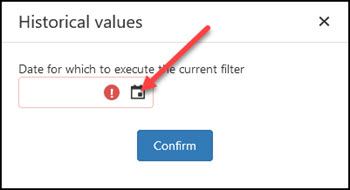

To do this click on the Historical Screener icon to open the Historical Screener date selector.

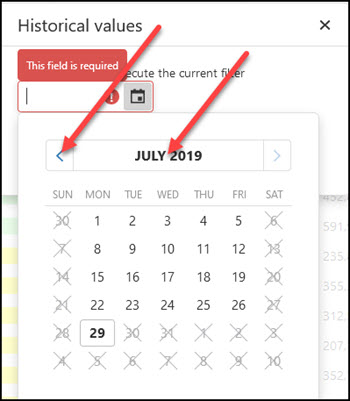

To select the date you would like to screen for click the date selector icon.

To select dates further in the past click the blue left arrow or click on the heading “JULY 2019” in the below screenshot.

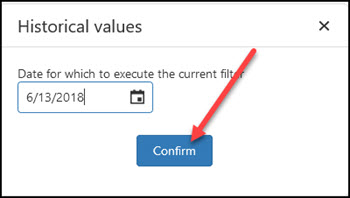

After selecting the date click Confirm to get the historical screener results.

That is all you have to do to screen past results.

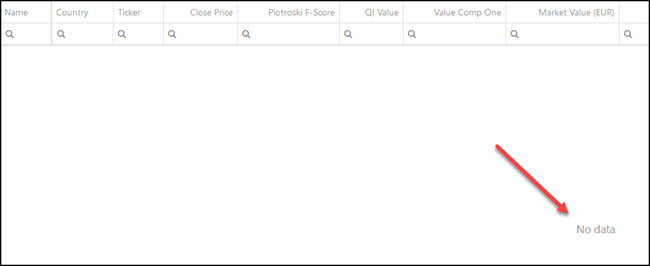

If there is "No Data"

Even thought you can only select weekdays in the point in time database it may be that the day you selected was a market holiday. This may be the case around the start of the year.

If it was a market holiday you will see a "No data" message like this:

If you do get the No data message simply select a day before or after the date you selected.

PS Not a subscriber to the Quant Investing stock screener yet? Sign up here.

PPS Why not sign up right now before it slips your mind?

Click here to start back testing your investment strategy Now!