We recently added the Value Composite Two indicator to the Quant Investing stock screener.

It helps you find undervalued companies

The Value Composite Two, the same as Value Composite One is an single indicator you can use to find undervalued companies using six valuation ratios.

It was developed by James O’Shaughnessy and explained in the latest edition of his excellent book What Works on Wall Street: The Classic Guide to the Best-Performing Investment Strategies of All Time.

How is it calculated?

Value Composite Two is calculated using the following six valuation ratios:

- Price to book value

- Price to sales

- Earnings before interest, taxes, depreciation and amortization (EBITDA) to Enterprise value (EV)

- Price to cash flow

- Price to earnings

- Shareholder Yield (Dividend yield + Percentage of Shares Repurchased)

In the screener the Value Composite Two has a value of between 0 (undervalued company) and 100 (expensive or overvalued company).

Difference between Value Composite One and Two

The difference between Value Composite One and Two is that Value composite Two has one extra ratio - Shareholder Yield (Dividend yield + Percentage of Shares Repurchased).

Companies are thus ranked by one additional indicator - how much money they have returned to shareholders.

You can read more about shareholder yield here - Dividend investor - This ratio beats dividend yield.

More information and back test

We have not back tested the Value Composite Two indicator yet but we have tested its close relative Value Composite One.

You can find more information (including back test information) here: This combined valuation ranking gives you higher returns - Value Composite One

Where to find Value Composite Two in the screener?

You can easily find undervalued companies using Value Composite Two in the screener.

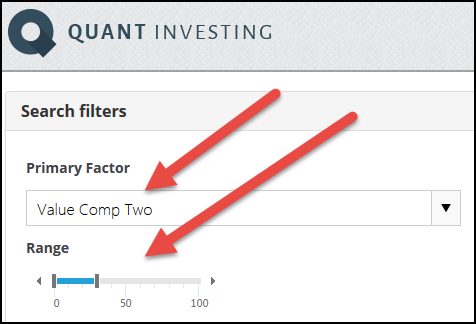

This can be done as a primary screening factor as shown below:

Slider makes it easy

The slider allows you to easily select the most undervalued Value Composite Two companies, for example, cheapest 30% in the above screenshot.

Sort by Value Composite Two

You can also sort any screen you run by Value Composite Two, simply click on the column heading to sort the column (remember a lower value means more undervalued).

PS To start using Value Composite Two to find undervalued companies for your portfolio sign up here.

PPS Why not sign up right now before you get distracted.